AI Is Changing How Users Discover Products

Thomas Schiavone

March 27, 2025

Search is evolving—and fast. At Courier, we’ve started to see a shift in how users are finding us.

Google still dominates product discovery. It remains the primary starting point for most users—and for most products, the largest source of referral traffic.

But something new is happening.

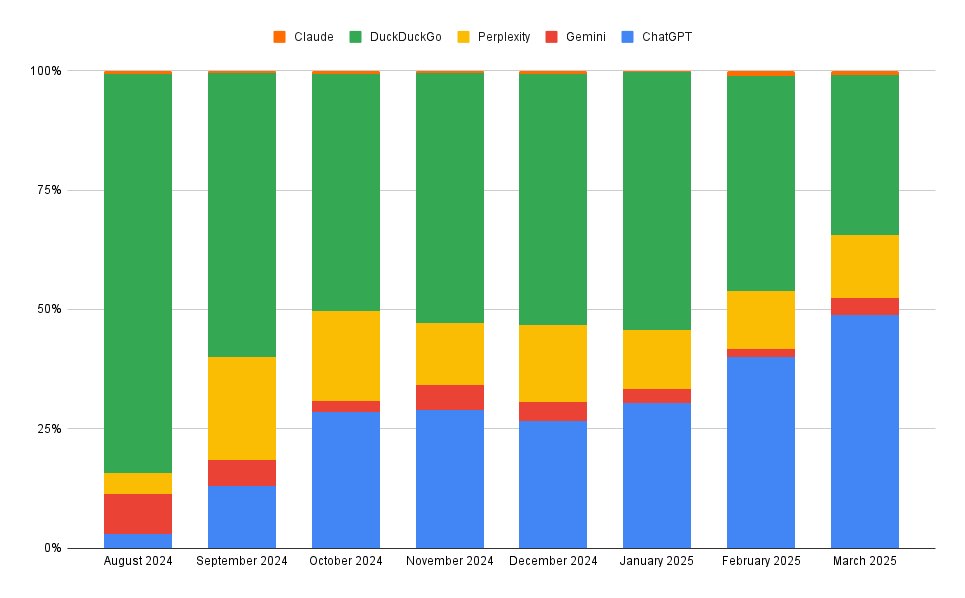

Over the past six months, ChatGPT has become a meaningful source of inbound traffic. It has already overtaken DuckDuckGo in our referral data and, at its current pace, will surpass Bing this year.

Perplexity showed early promise and gained traction among technical users, but its growth has since plateaued. We’ll come back to that.

Other tools, like Anthropic’s Claude, have recently introduced web search capabilities, but they barely register in our data. This shift isn’t about AI in general—it’s about a very specific change in behavior: people are using ChatGPT to find and access products directly.

And that’s starting to show up in the numbers. Here’s a breakdown of referral traffic from AI chat tools compared to DuckDuckGo, our lowest-performing search engine.

ChatGPT Is Becoming a Discovery Surface

When traffic from ChatGPT first appeared, it was a novelty. But since late 2024, that trickle has turned into a steady, measurable trend.

Month over month, ChatGPT has grown faster than any other non-Google source.

Today, it’s not just outpacing DuckDuckGo—it’s catching up to Bing. And this isn’t the result of a one-time spike. It reflects a real shift in how users are finding products.

This isn’t something to watch passively. It’s time to treat ChatGPT the way you treat search engines. The mechanics are different, but the effect is the same: visibility matters. The more clearly and authoritatively your product shows up in AI-generated answers, the more likely it is users will click through and engage.

ChatGPT vs. Bing: The Gap Is Closing

Bing has been a steady, if modest, source of referral traffic for years. But ChatGPT is closing in—fast. If trends hold, it will overtake Bing within the next six months.

That said, our data may reflect the nature of our product. Courier is built for developers and product teams—audiences who are often ahead of the curve in adopting new tools like ChatGPT. Our content also aligns well with the kinds of queries AI tools can answer today: implementation questions, comparisons, integration how-tos.

That might not be true yet for other products... yet. As search models improve and user behavior shifts, we expect this pattern to extend well beyond technical categories.

Perplexity: Early Traction, Then a Plateau

Perplexity was one of the first AI tools we saw show up in our referral data. It gained traction quickly and briefly looked like it could become a meaningful channel.

But since then, growth has stalled. Traffic from Perplexity has remained flat, even as ChatGPT continues to climb.

The most likely reason comes down to brand and distribution. ChatGPT benefits from massive exposure and widely regarded as the default AI interface. Perplexity, while respected in certain circles, doesn’t have the same reach or default presence.

It still appears in our data—but it’s not growing. That’s not a good sign for Perplexity’s long-term relevance as a discovery surface.

Claude: Present in the Market, Absent in the Data

Anthropic’s Claude has been in the market a while but it’s the lowest by far among the AI assistants we track (we're giving Grok a pass for now).

This isn’t surprising. The dominant way Claude is used today is through its API, not its user interface. That may change over time. But today, Claude simply isn't showing up as part of the product discovery journey—not in any meaningful volume.

Google Still Dominates—But It’s No Longer Alone

Google continues to drive the majority of our discovery traffic. That hasn’t changed.

But the landscape around it is shifting. ChatGPT is now a serious alternative. And even Google is adapting. Gemini—Google’s own AI assistant—has started to appear in our referral data. It’s still small, but it’s growing. AI-assisted search is clearly becoming a core part of Google’s future.

For now, Google remains dominant. However, AI assistants are no longer a novelty—they’re becoming the new front door to the internet.

Similar resources

The First 48 Hours: Onboarding Notifications That Keep Users Around

The first 48 hours after signup are when users decide if your product is worth their attention. Every notification you send is an audition. Most teams blow it by sending too much too fast: welcome email, feature announcement, tip, CEO note. Day one and you've already trained users to ignore you. This guide breaks down what to send (and what not to send) in the critical first 48 hours, with timing frameworks, example sequences, and the one metric that matters more than open rate. Includes templates for signup confirmation, activation prompts, and day-two follow-ups.

By Kyle Seyler

February 02, 2026

What Is Alert Fatigue?

Alert fatigue occurs when users become desensitized to notifications due to high volume, leading to ignored alerts, missed critical information, and decreased engagement. This problem affects product notifications, DevOps monitoring, healthcare systems, and security operations. This guide covers the psychology behind alert fatigue (habituation and the "cry wolf" effect), how to measure it (open rates, dismiss rates, time-to-action), and five practical strategies to reduce it: batching, prioritization, user preferences, smart channel routing, and timing optimization.

By Kyle Seyler

January 23, 2026

SMS Opt-Out Rules in 2026

TCPA consent rules changed in April 2025. Consumers can now revoke consent using any reasonable method, including keywords like "stop," "quit," "end," "revoke," "opt out," "cancel," or "unsubscribe." Businesses must honor opt-out requests within 10 business days, down from 30. The controversial "revoke all" provision, which would require opt-outs to apply across all automated messaging channels, has been delayed until January 2027 and may be eliminated entirely. SMS providers like Twilio handle delivery infrastructure and STOP keyword responses at the number level. They don't sync opt-outs to your email provider, push notification service, or in-app messaging. That cross-channel gap is your responsibility. Courier provides unified preference management that enforces user choices across SMS, email, push, and chat automatically.

By Kyle Seyler

January 13, 2026

© 2026 Courier. All rights reserved.